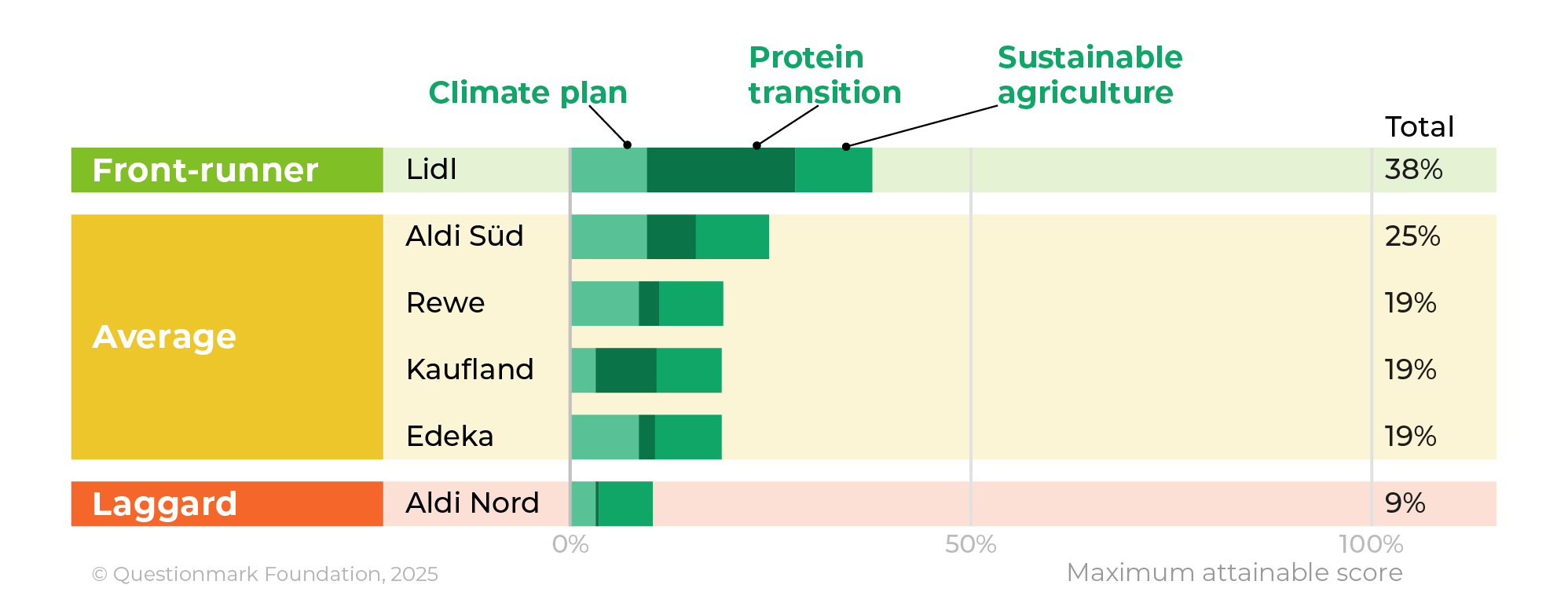

The first promising steps are visible, but there is still significant room for improvement when it comes to sustainability in the German food retail sector. This is the conclusion of the first ever »Superlist Environment Germany« produced by the think tank Questionmark in collaboration with the Albert Schweitzer Foundation, ProVeg, Madre Brava, and PAN International. Under review: the strategies and goals of Germany’s six major supermarket chains – Aldi Nord and Süd, Lidl, Kaufland, Edeka, and Rewe – in the areas of climate protection, protein diversification, and a more responsible approach to agriculture.

Good goals alone are not enough

The retailers featured in the Superlist Environment collectively account for over 60% of the German market. This gives them a decisive role in shaping a sustainable, healthy, and more animal-friendly food system – and in contributing to climate neutrality. In late 2024, Questionmark examined whether these companies have set themselves concrete goals, know how they intend to achieve them, and have already taken meaningful steps to do so. This much can be said upfront: so far, there is little evidence of progress on store shelves or in store flyers. While the companies seem to acknowledge their responsibility, their commitment remains lacking when it comes to concrete strategies, transparency, and putting their words into action.

Topping the 2025 ranking is Lidl: The discounter aims to shift its sales from animal-based to plant-based proteins, has set clear milestones to reach this goal, and is already reporting publicly on its progress.

Aldi Süd, along with full-range retailers Rewe, Kaufland, and Edeka, ranks in the middle – but their efforts around protein diversification remain far less ambitious than Lidl’s.

Among the companies in the study, Aldi Nord is the only one that has not yet committed to the EU’s 2050 net-zero target – and it provides no disclosure on its emissions directly related to food (Scope 3).

Despite some promising approaches, all retailers still lack sufficiently concrete climate action plans with clear interim targets. In many cases, the supermarkets’ current practices even contradict their own goals: for instance, over 90% of the proteins advertised in store flyers are of animal origin, and many of the meat portions on offer are extra-large. Furthermore, none of the companies disclose what share of their sales is certified by sustainability labels, nor do they present concrete plans to promote sustainable farming practices. Clearly, there is still significant room for improvement.

In the focus: the protein split in the sales mix

One particularly effective lever for creating a sustainable food system is to increase the share of plant-based relative to animal-based proteins in the retailer’ sales mix. This shift can be supported through targeted marketing, pricing strategies, and prominent in-store placement of plant-based products.

Targets & transparency

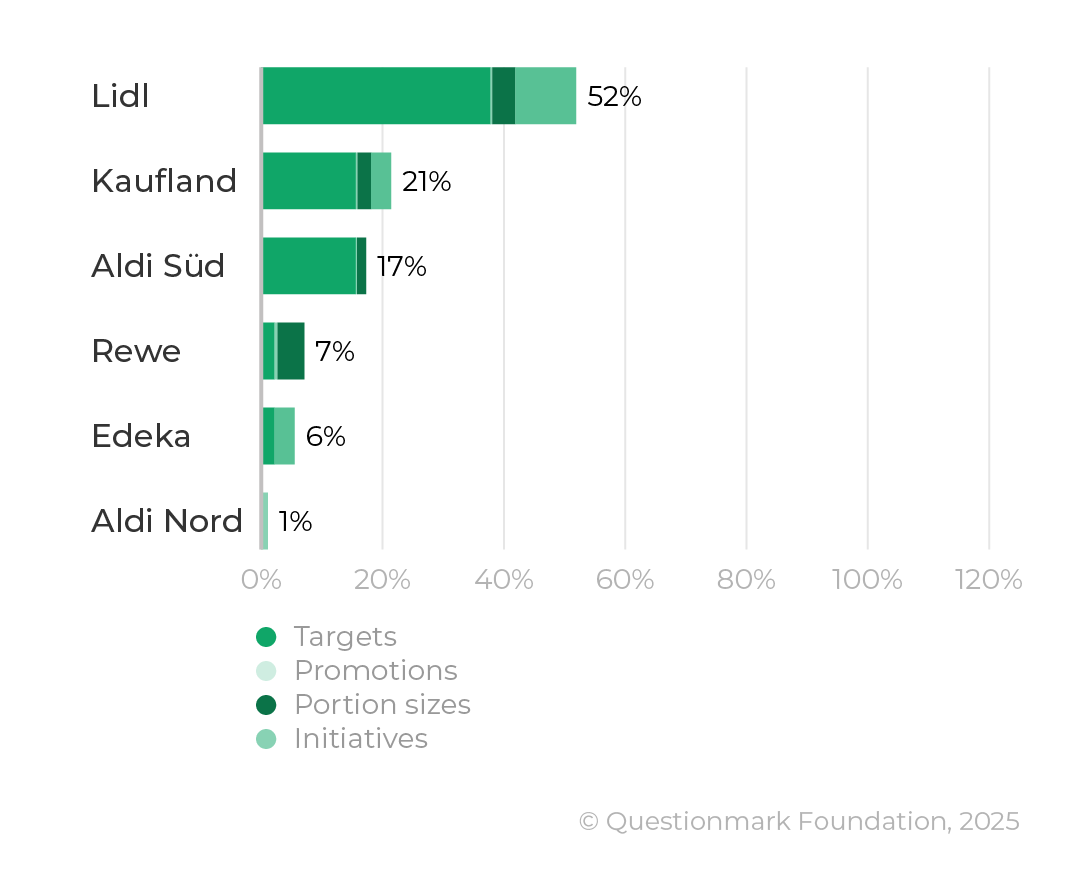

Lidl is currently the only supermarket with a specific protein-related goal. Following the recommendations of the Planetary Health Diet, the discounter aims to increase the share of plant-based proteins in its sales to 60% by 2050. By setting this target, Lidl is taking on a pioneering role and has also defined an interim target of reaching 20% plant-based proteins by 2030.

Lidl and Kaufland (Schwarz Group) already publish data on their respective protein sources. Aldi Süd reports the proportion of its overall product range that is plant-based, although this figure is less meaningful. Companies still use different calculation methods, making comparisons difficult. While Lidl and Kaufland apply the WWF Protein Disclosure Method – which Rewe also plans to adopt – Aldi Süd currently uses an in-house approach.

Edeka has at least acknowledged its role in the protein transition. However, no specific targets, reporting, or concrete measures have emerged so far. Aldi Nord has yet to publicly recognize its responsibility in this area.

Measures: advertising, portions, placement, price

Whether goals are met – or even progress is made – depends largely on whether retailers succeed in making plant-based products attractive to their customers and promoting their sales in the process. In this regard, there is clearly room for optimization: none of the companies stands out particularly positively. On average, 92% of the proteins advertised in weekly brochures are still of animal origin – that is meat, fish, dairy, and eggs.

Moreover, 68% of schnitzels, burgers and cordon bleus in the product range are extra-large portions, meaning they weigh more than 150 grams – even though the German Nutrition Society (DGE) recommends consuming no more than 300 grams of meat per week. Rewe currently has the lowest share of extra-large portions at 52%.

At least Edeka, Kaufland, and Lidl are now increasingly offering plant-based alternatives at the same price as their animal-based counterparts. Lidl is also strategically placing these alternatives next to conventional animal products to enhance visibility and accessibility. Several other initiatives of the food retailers aim to raise consumer awareness of plant-based proteins. However, the study’s authors criticize that the scope and consistency of implementation often remain unclear. For example, Lidl occasionally promotes its plant-based line with the slogan »The choice is yours«, offering these products at the same or even a lower price than their animal-based equivalents. In January 2023, Rewe displayed the climate costs of various food items in selected stores and on its social media platforms. Most retailers are also actively communicating the expansion of their plant-based offerings.

Figure 4: Protein diversification initiatives undertaken by food retailers

Recommendations

On the path to a more sustainable food system, transparency is the first step toward improvement – and must be followed by concrete action. Comparable and specific data on climate impact, protein sales, and sustainability certificates are essential for identifying areas for optimization and setting clear targets. The following measures are recommended:

- Climate protection: Reports on all emissions, including indirect ones from supply chains (Scope 3), are recommended, differentiating between agricultural and industry-related emissions. A concrete action plan, including interim targets for Scope 3 emissions, makes it easier to achieve the net-zero emissions target.

- Protein diversification: Specifying the ratio of animal- and plant-based proteins in total sales using standardized measurement methods enables comparability between food retailers. In line with the recommendations of the Planetary Health Diet, targets should be set and a concrete SMART action plan with clearly measurable actions should be developed to promote the transition to a sustainable, plant-rich diet. Many effective measures are not yet sufficiently utilized by retailers: There is particular potential in price parity, better product placement and a significantly higher proportion of plant-based proteins in advertising.

»Responsible companies set themselves ambitious goals and report transparently on their progress – but this is by no means the case for all six companies surveyed«, laments Esther Erhorn, Interim Director of Corporate Outreach at the Albert Schweitzer Foundation. »Too often, responsibility is still shifted onto the consumer. We expect all food retailers to recognize their role and to work actively, consistently, and transparently toward a sustainable future.«

The Albert Schweitzer Foundation offers its support to companies willing to take this path.

Developments since data collection

After the investigation was concluded, Kaufland did end up publishing data on its Scope 3 emissions, and Rewe announced that it is currently developing a protein strategy with concrete targets and intending to actively support the food transition. It remains to be seen how these efforts will take shape.