What do you know about the meat that ends up in your shopping cart? The label on the packaging may promise animal welfare - but how reliable is it?

Our latest ranking sheds light on just this question, investigating how seriously the biggest supermarkets and discounters take animal welfare. What goals do they have and who has made real progress in this field since the last check in 2020?

Our assessment is based on the companies' own public purchasing guidelines, which we analyzed thoroughly and evaluated based on strict animal welfare criteria. We focused in particular on the requirements for several animal species - from chickens raised for meat, so-called broiler chickens, to fishes.

Our results show a lot of shadow and only little light: Although many supermarkets are making efforts to improve animal welfare, there is still a long way to go before real progress is made. No supermarket scores really well; the results are mediocre at best.

Alle Informationen zum Ranking als Download

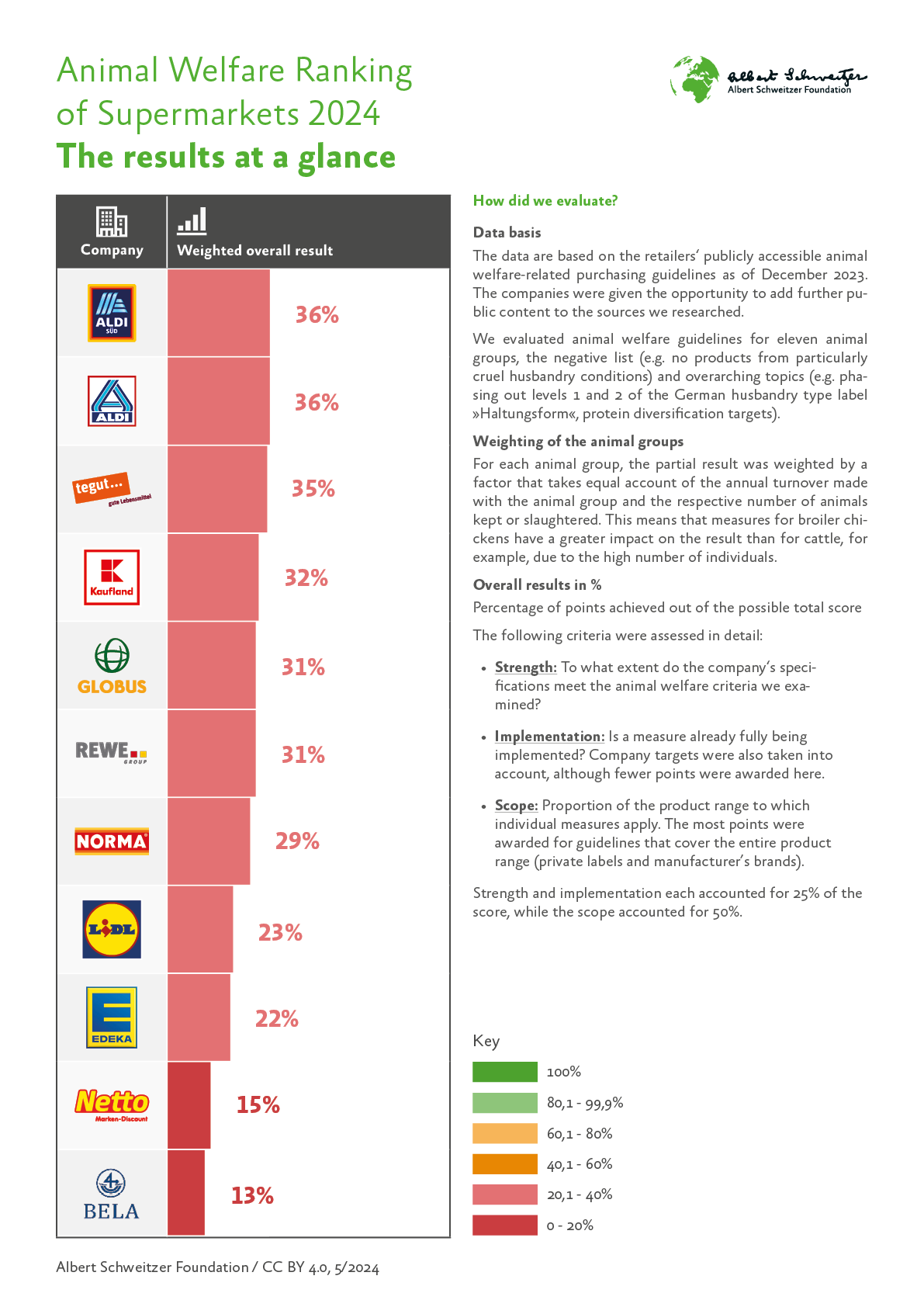

The results at a glance

Our last ranking in 2020 still had a clear frontrunner. Now the gaps have narrowed, with the top six companies close together and all scoring between 31% and 36% of the possible points. Aldi Süd and Aldi Nord have improved slightly compared to 2020 and occupy the top positions, closely followed by Tegut.

Tegut and Globus saw the most significant changes. Tegut left all competitors behind in 2020 but has now dropped significantly. Globus, on the other hand, climbs from last place to fifth.

Alongside Globus, Kaufland, the Rewe Group and Norma are in the midfield. Lidl has lost several places. Bringing up the rear are Edeka, Netto Marken-Discount and Bela (Famila), which were already in the bottom third of the ranking in 2020. Overall, better animal welfare is still progressing too slowly despite the clear efforts of many companies.

Highlights

Better minimum standards for broiler chickens

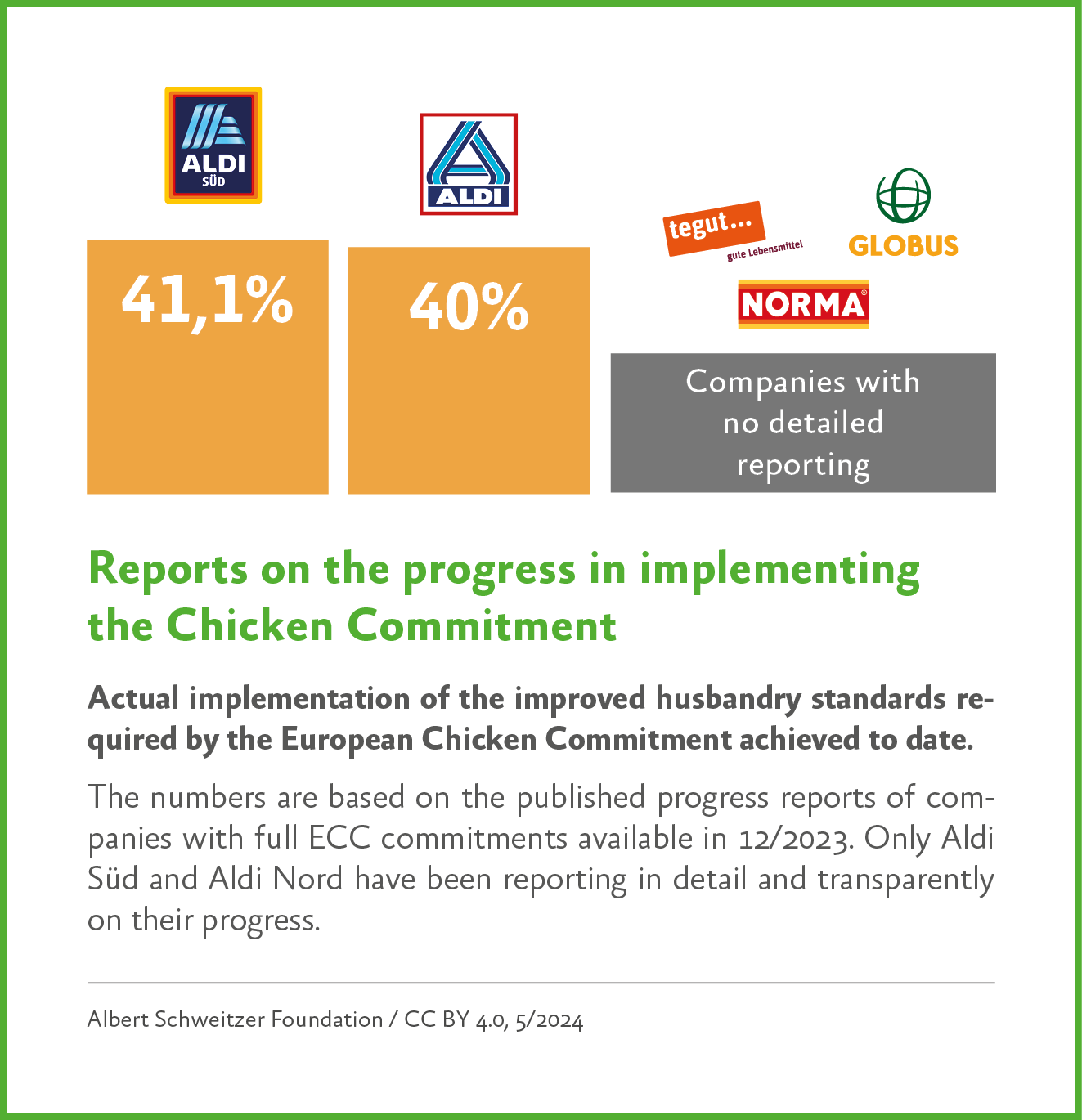

With more than 600 million animals a year, broiler chickens account for around 84% of the land animals raised and slaughtered in Germany. Joining the European Chicken Commitment and implementing its standards therefore offer enormous potential to reduce animal suffering. Fortunately, a lot has happened here since the last ranking. Five of the eleven ranked companies have joined the Chicken Commitment in May of 2024 and are in the process of transition. In July 2024, the Rewe Group has followed suit.

Detailed, public progress reports are very important in order to make supply chain transition visible. Aldi Süd and Aldi Nord are standing out positively here. While other retailers are not yet able or willing to communicate the progress of their transition in detail, Aldi Nord and Aldi Süd provided good examples of transparent reports with reliable figures: They communicated their percentage transition achieved so far, broken down according to the criteria of the Chicken Commitment (see detailed chart). In this year's ranking, we have not yet included the percentage progress in the overall scoring, but we will place greater emphasis on this in future.

The other supermarkets and discounters, above all the industry giants Lidl and Edeka, must now also move to not only promise animal welfare, but also implement it.

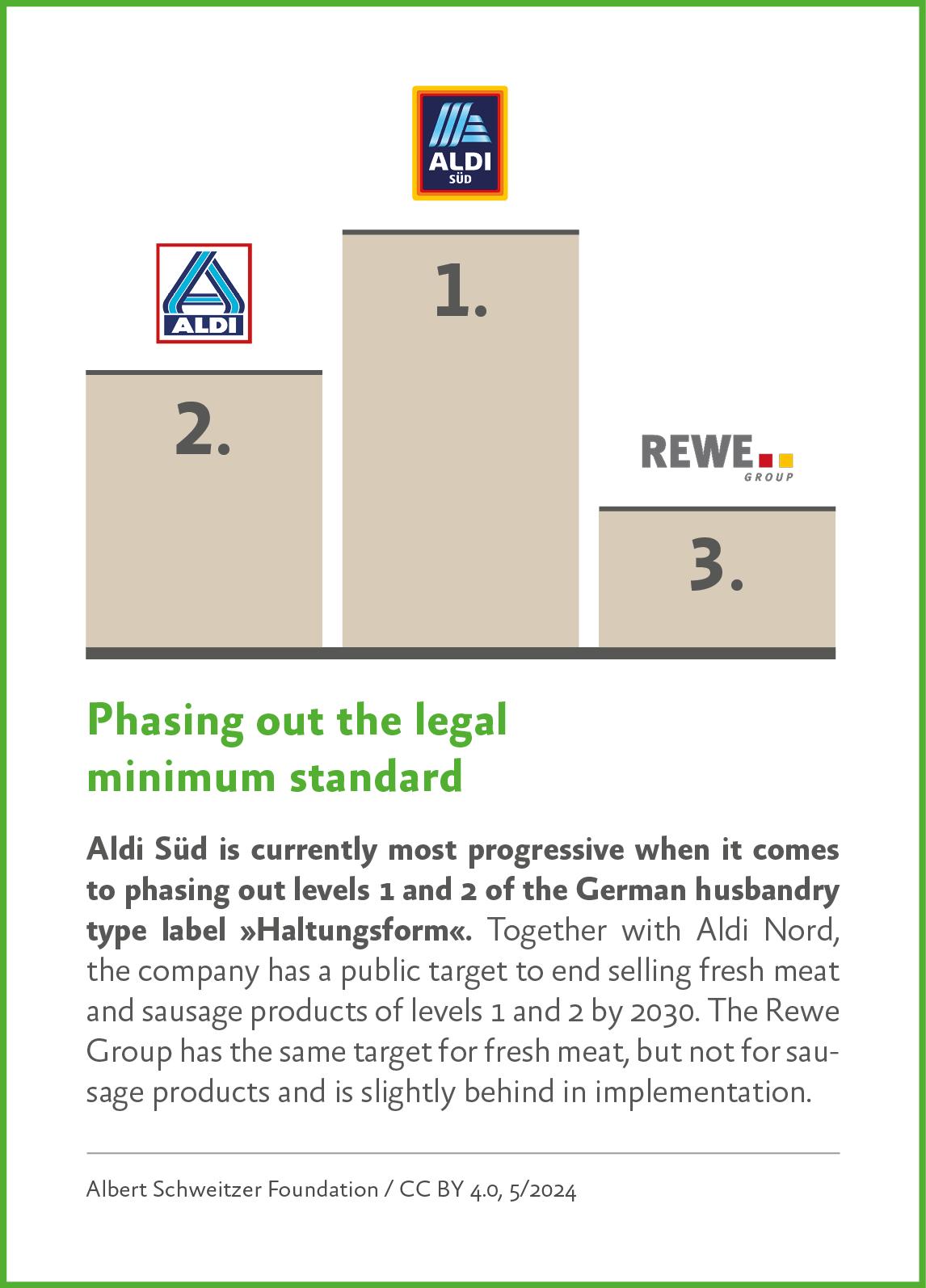

Phasing out levels 1 and 2 of the »Haltungsform« label

One of the key animal welfare issues for retailers and a widely used industry solution is the »Haltungsform« label. Retailers use this label to show the conditions under which meat and milk were produced. From an animal welfare perspective, the lowest levels 1 and 2 are unquestionably problematic and only level 3 involves noticeable improvements for the animals. In 2020, our demand was to phase out at least level 1 – at the time, only Lidl, Kaufland and Rewe had at least issued non-binding targets. Four years later, Aldi Nord and Aldi Süd have published the most concrete targets for phasing out level 2 and publicly report the greatest progress in transitioning to levels 3 and 4 (see detailed graphic). Other retailers have less binding or less comprehensive plans. Three of the companies surveyed (Tegut, Globus, Norma) are still not participating in the »Haltungsform« program, nor have they published their own equivalent phase-out plans for the legal minimum standards.

In addition to the swift and comprehensive phasing out of levels 1 and 2, two aspects are particularly important from an animal welfare perspective in the next few years: Firstly, the standards for levels 3 and 4 must be extended to cover all relevant animal species. Secondly, they must be raised as a whole. The the current »Haltungsform« criteria can only be regarded a start – this becomes obvious when compared with the assessment criteria of our analysis. Only a few of the many animal welfare-relevant aspects of our criteria are met by the requirements of the »Haltungsform« label; in these cases, the companies were awarded the corresponding points.

We will continue to keep an eye on developments at German retailers and the necessary improvement of the »Haltungsform« label.

Further focal topics

For further information on the focal topics see the detailed reader (in German).

The results of the companies in detail

Aldi Süd and Aldi Nord each achieve 36% of the possible points and thus take the lead in the ranking. Among other things, the discounters scored points for their animal welfare guidelines for laying hens, chicks and pullets: Aldi is switching its private label products to eggs produced in compliance with KAT standards and reports on this transparently.

Aldi is also making progress with fishes from aquaculture. The discounter is increasingly using certificates that meet the requirements of the Aquaculture Welfare Standards Initiative (AWSI) which guarantee stricter animal welfare criteria. Aldi has also taken steps forward in the certification of wild-caught aquatic animals.

Aldi Nord and Aldi Süd have announced that they will completely phase out levels 1 and 2 of the »Haltungsform« label, which are particularly problematic in terms of animal welfare, by 2030. They have already achieved important interim goals in their implementation process. Aldi is also taking the first small steps to increase the proportion of plant-based proteins in its product range – although other retailers in Germany and abroad are already much better positioned in this field.

Tegut is making good progress with implementing the European Chicken Commitment. Another of the company's strengths are the partially comprehensive requirements for certain private labels. However, as these often exclusively apply to individual private label and organic products, only partial points were awarded.

In other areas, the development is less satisfactory. For example, this time the retailer published less detailed guidelines than in 2020. Among other things, we miss concrete targets for increasing the proportion of plant-based proteins and progress in switching to eggs produced in accordance with KAT standards for its private labels. Tegut is therefore the biggest loser percentage-wise and must now even be careful not to be left behind.

Kaufland has slightly improved its overall result. A positive aspect is the broad scope of many of its husbandry requirements.

Unfortunately, Kaufland has still not joined the European Chicken Commitment. The company is also in danger of falling behind the competition when it comes to the protection of fishes and other aquatic animals. There are also obvious weaknesses in the transition of private label products to KAT-standard compliant eggs and in the expansion of the product range in terms of vegetable proteins.

Globus has made a considerable leap forward. In the overall ranking, the supermarket lies only a few percentage points behind the top four companies. This is mainly due to the first-time publication of an explicit and separate animal welfare policy. Globus has joined the European Chicken Commitment and was one of the first companies in Germany to completely phase out eggs from caged hens. The supermarket also improved significantly in almost all other categories assessed. It received high scores for the negative list, for example, which excludes trade in very cruel animal products.

Unfortunately, Globus has not yet set itself any targets for moving away from the legal minimum standard for private label products (comparable to a withdrawal from »Haltungsform« levels 1 and 2). We have also yet to see a strategy for increasing the proportion of plant-based proteins in its product range.

Like Globus, the Rewe Group comes in at 31% based on the data available in December of 2023. With a full and timely support of the European Chicken Commitment and the switch to the corresponding products, Rewe could have been further ahead.

In the Rewe Group's animal welfare guidelines, for example, the relatively high score for dairy cows stands out positively. With regard to the negative list, the supermarket is also doing quite well, although there is still a lack of a complete and animal welfare-friendly phase-out of chick killing (for shell eggs and processed eggs in private label products). On a positive note, we see the planned phasing out of levels 1 and 2 of the »Haltungsform« label, and the progress made on fish standards.

Norma has made up one place since 2020 and almost doubled its result in the overall ranking. The company joined the European Chicken Commitment very early on. Unfortunately, it only achieved scores in the single digits for the animal welfare guidelines for most animal species.

The guidelines for dairy cows and rabbits stand out positively. Norma is also at the forefront in the areas of »cage-free«, the ending of beak trimming as well as chick killing and the targets for increasing the proportion of plant-based proteins in its product range. However, there is still a lot of room for improvement when it comes to switching to eggs in private label products in accordance with KAT standards. Unfortunately, Norma has also not published any targets for moving away from the legal minimum standard for private label products.

Lidl has slipped several places. We particularly criticize the fact that the discounter still refuses to join the European Chicken Commitment.

One positive aspect is its strategy for plant-based proteins which currently is progressive when it comes to the German market and with which the company has taken the lead in this important area. The discounter wants to increase its proportion of plant-based proteins to 20% by 2030. Most of the plant-based products of the Vemondo private label will also be priced in line with the corresponding animal products.

Lidl is part of the »Haltungsform« program, which the company itself helped to set up. At the time of data collection Lidl had only published a binding target for level 1, but not for phasing out level 2 for all animal species. This is regrettable, as there is only a real chance of raising the minimum standards if the retailers phase out the two worst levels for all animal products. Lidl also has some catching up to do when it comes to the general exclusion of beak trimming and the switch to KAT standards for private label eggs.

Despite improving its result by a good six percentage points, Edeka slipped down several places from the midfield. The fact that the retailer has not yet signed up to the European Chicken Commitment – and that the competition is also taking a much more ambitious approach to other issues – also played a decisive role here.

Although Edeka is a member of the »Haltungsform« program, it is still far behind when it comes to phasing out the particularly problematic levels 1 and 2. Edeka’s animal welfare guidelines range from 0% for geese and ducks to 43% for dairy cows. The predominantly small scope limits Edeka's points: The supermarket often only offers locally limited programs and labels. The company could collect more points with specifications for its entire product range, especially for all private labels. Finally, Edeka has a lot of catching up to do when it comes to phasing out the killing of chicks.

Our conclusion

Our comprehensive analysis shows that, despite increased efforts and some progress, supermarkets and discounters still have a very long way to go. None of the companies analyzed achieved an overall rating that can be described as good.

The commitment of some companies to improve conditions for broiler chickens and in aquaculture shows that changes are possible. Overall, however, progress is too slow, is not communicated transparently or is not tackled at all.

What you can do

Every purchase is a decision for or against animal welfare. If you want your own diet to cause as little animal suffering as possible, you are best advised to choose plant-based alternatives to meat, milk and other animal products.

Our assessment is based on the animal welfare policies of the selected supermarkets and discounters, which were publicly available in December 2023. Companies were given the opportunity to add further public content to the sources we researched before we started our evaluation.

The companies could collect points in the following areas:

- Animal welfare guidelines for eleven animal groups

- Negative list

- Overarching topics

The subject areas were weighted depending on two factors (the annual Germany-wide turnover with the respective animal group and the number of animals slaughtered).

We evaluated the strength and implementation of the measures described in the guidelines (full points were awarded for comprehensive, fully implemented measures) as well as the scope: The guidelines covering the entire range of private labels and manufacturer’s brands received the most points. The overall result of a company per topic (in %) represents the ratio to the possible total number of points.

Detailed information on the methodology used can be found in the ranking [reader](https://albert-schweitzer-stiftung.de/aktuell/supermaerkte-tierschutz-ranking-2024#) (in German).